The personal savings and insurance gap in the UK has been well publicised. It’s now clear that successive governments want to transfer some responsibility for addressing this onto employers. Bright Wealth Management Director Ian Crombleholme explores some of the issues that all employers will need to address.

Let’s face it, when it comes to managing a club there are always too many things to do on a daily basis and not enough hours in the day. This means that club managers may have little time to think about their own financial objectives, or protecting their club from the many risks that may derail their progress. Taking a step back to look at the long term situation is not always a priority. As a result, planning your own and your employees’ financial security can become daunting, neglected or completely overlooked. However, help is never too faraway.

In addition to looking after personal finances there are many aspects of corporate financial planning for club managers to consider. Tax mitigation, managing the club’s cash balances and protecting against various risks are all good examples, but two areas in particular are of key significance.

Employee benefits

Rather than being a ‘nice to have’, an effective employee benefit strategy should be viewed as a tool to help retain key personnel and recruit new talent. There is a wide range of options under the heading of employee benefits. You should take time to discuss these with an expert. Find out which employee benefits are appropriate for your staff.

Flexible benefits – allows employees to create a benefits package that meets their own individual needs. This enables you to respond flexibly to the requirements of potential recruits.

Salary sacrifice arrangements – this allows employees access to tax-efficient benefits and helps reduce employers’ National Insurance costs at the same time.

Private Medical Insurance – This can help protect your employees’ health and well being thereby reducing their potential absence from work when, for example, waiting for medical treatment.

Group Life, Income Protection and Critical Illness – these are important benefits that not only form a key part of a comprehensive employee benefits package but could also enable you to manage your club more effectively by:

- Providing the means to support your employees and their families financially during a particularly difficult time.

- Allowing you to recruit temporary employees.

- Providing access to a range of rehabilitation services, employee assistance programmes and absence management services that assist you to meet your statutory obligations and manage employee absence more effectively.

The Workplace Pension

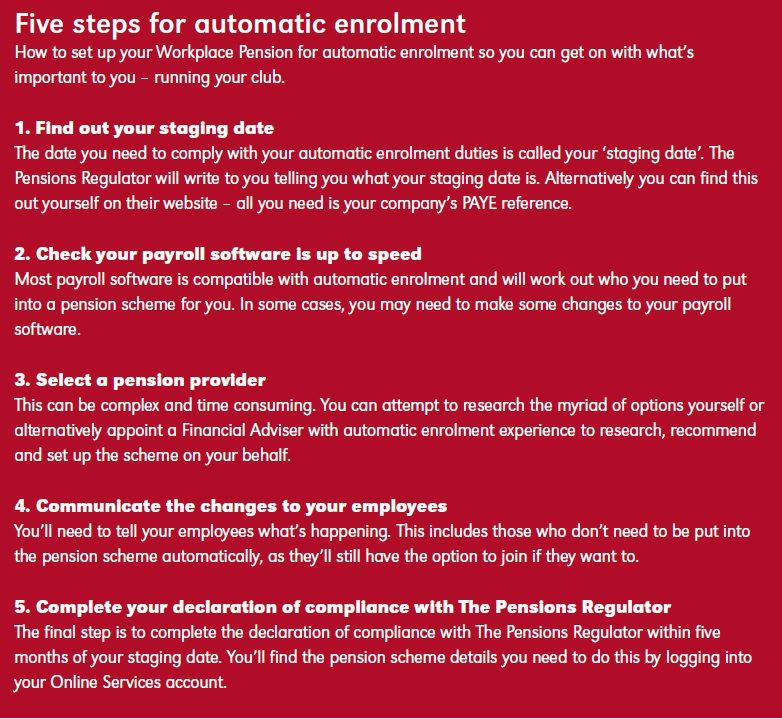

It’s likely you’ve seen or heard the adverts regarding the Workplace Pension, but despite all the coverage there continues to be questions and uncertainty. In simple terms, if you employ at least one person you will need to comply with the automatic enrolment legislation. This means you have a legal obligation to offer a pension scheme. You will have to enrol certain employees into that pension scheme automatically and also pay money into their pension pots. You are also obliged to let your other employees know they can join too. It sounds straightforward but it can quickly become complicated.

The process begins once you have found or been sent your ‘staging date’ via the Pensions Regulator. At this point the clock is ticking. You will need to comply with the legislation by this date or you could receive a fine. Put into context, a small business with 20 employees that doesn’t comply on time would be fined £400, and for continued non-compliance could attract further fines of £500 a day. So to avoid incurring any penalties, planning is essential.

It is possible to set up a scheme yourself, but it’s not recommended unless you have experience in this field. The sheer number of hours that this kind of undertaking can leach from you and your team’s schedules can be quite staggering.

Selecting a pension scheme, checking your payroll software, communicating to staff and finally submitting your declaration of compliance to the Pensions Regulator can all pose their own challenges and cause delays if not tackled correctly. Once you have set up the scheme for your employees there’s also the matter of ongoing maintenance to ensure the scheme remains compliant and that the underlying investments are performing to an acceptable standard.

The Workplace pension and automatic enrolment can be a challenge but with careful planning, time and the correct support it is something that all clubs should take in their stride. Of course, many clubs will have already implemented pension/employee benefits schemes in the past. Regular reviews are recommended to ensure you are providing the best possible solutions to your employees and that the costs to the club remain competitive.

Finally, but most crucially, it is vital to ensure that your staff genuinely understand any employee benefits provision that you may operate. If employees don’t understand their employer’s provisions for pensions and insurances, it’s possible they could be wasting money on unnecessary private arrangements or be unaware of potential tax issues further down the line.

Ensuring that staff properly understand their employer’s pension/employee benefit provision will also make sure the employer gets value for money on their spend in this area. If your staff do not understand what is being provided they will not attach much value to it. The value of the pension can go down as well as up. The member may get back less than they invested. The levels and bases of taxation, and reliefs from taxation, can change at any time and depend on individual circumstances.

To discuss your financial situation, review your existing finances or to start planning the financial future of your club, feel free to contact

Ian Crombleholme.

t. 07796 442 669

e. [email protected]

www.brightwm.co.uk